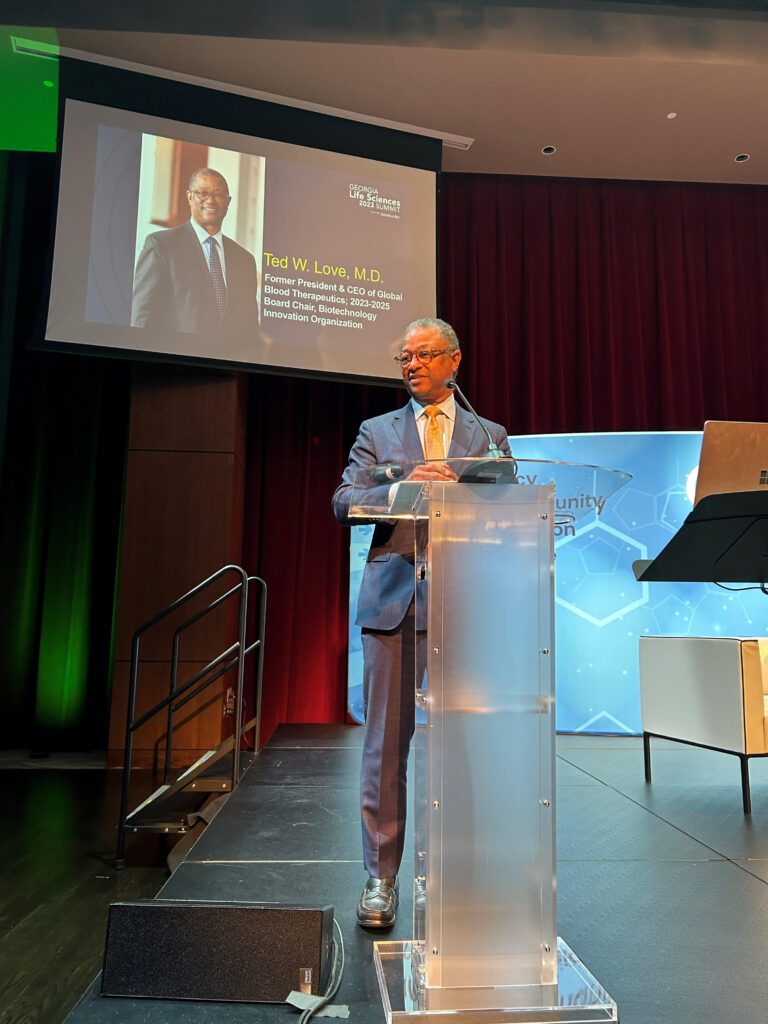

Dr. Ted W. Love: How to reframe the narrative about biotech – and put patients first

November 2, 2023 / Source BIO News

Remarks from Dr. Ted W. Love, Chairman of the Biotechnology Innovation Organization (BIO) and former President and CEO of Global Blood Therapeutics, as prepared for delivery Georgia Bio’s Life Sciences Summit on November 1, 2023:

Almost ten years ago, when our college-aged daughter Alex lived at home, I had a difficult time convincing her that our industry was a force for good. We talked a lot about the biopharma industry, and I felt like I was living with Bernie Sanders!

So one day I asked her, “Would you work at Global Blood Therapeutics for the summer and help us build our patient advocacy initiative?” She did, and she saw everything that we do – internally, externally, and in partnership with patient advocates.

She saw first-hand that the patients were our inspiration and drove how we approached every issue. She saw our passion to conquer sickle cell disease , particularly because it had been historically overlooked and under-invested in. She embraced our motto that “we can’t fail because patients are dying!”

Alex had a great experience that summer. In fact, many patient advocates continue to ask me, “How is Alex?” Before she went back to school, Alex told me that she was wrong about our industry. She said, “I never imaged a collection of people working so hard, singularly focused on helping others!” Needless to say, I was proud of her and of our industry…in addition to feeling a little victorious.

How to reframe the narrative about the biotech industry

I think every parent here knows that it can be very hard to change your child’s mind. And heaven knows we’re still working on Bernie Sanders. But perhaps we can learn a lesson from my experience with Alex when it comes to re-framing the narrative of our industry.

I would like to remind us that 35 years ago, Fortune Magazine named Merck as the country’s Most Admired Company repeatedly. Yet these days, similar surveys are far less appreciative of our great companies. Frankly, it’s unacceptable to me that our industry, which develops amazing breakthroughs that save countless lives, is viewed so inconsistently.

Sadly, the public does not see the tremendous work, risk, and commitment required to bring innovations to them. This is a huge and unfortunate disconnect. And while image may not be everything, it can be – and has been – hugely consequential for us. It’s long past time to reframe our narrative to better reflect the facts!

For Ted Love, biotech is personal

This is a personal campaign for me. I grew up in Alabama, and the Jim Crow South. I was one of eight children growing up on a farm, and my parents worked hard to provide us with opportunities that they never had.

My father had a fourth-grade education, fought in the Korean War, and worked in a warehouse to support us. My mother held down our house, which was quite an undertaking with five boys and three girls.

I learned so much from my parents, but I was also inspired by the doctor in our segregated community. I decided that I too wanted to be a physician and help others, just as he helped us.

Years later, working at Mass General Hospital in Boston, I saw how medical innovations drastically improved lives. Yet I also witnessed drugs and therapies failing to reach a segment of our society.

It was disappointing, embarrassing, even horrifying to see how the healthcare system could mistreat people of color and the most vulnerable. I’ll never forget watching sickle cell patients endure egregious discrimination and unsympathetic healthcare. Ultimately, my personal experiences, coupled with sage advice from mentors, convinced me to accept a position at Genentech when it was a much smaller and riskier company, to try and impact health care at scale. And that’s what we do every day.

‘Biotechnology is our only hope’

Showing the public how we change lives through innovations is a huge task that we must all embrace! But, we can do this by telling everyone we talk to about biotechnology is our only hope – to fight egregious diseases and future pandemics, to produce clean energy to fight climate change, to solve food insecurity , and to provide biodefense to keep us all secure.

We need to increase awareness of what we are achieving in our society, by telling our powerful stories of innovation and standing up for science.

It will require highlighting the possibilities of mRNA vaccines , gene therapy , crop editing , and the many other amazing technologies that we are investing in.

It will require highlighting both the opportunities and uncertainties of the innovation ecosystem, making it clear that the Inflation Reduction Act threatens our ability to deliver new, life-saving innovations.

Most of all, it will require building on our work to increase access.

I joined Global Blood Therapeutics because I never forgot the suffering of the sickle cell patients that I saw as a medical student and young physician. We developed Oxbryta as a breakthrough to attack the root cause of this insidious fatal disease. And last year, Pfizer acquired GBT to accelerate delivery of our innovative therapies to more patients around the world, particularly in Africa, India, and South America.

Helping to build GBT is one of the greatest achievements of my life. Yet ensuring that these therapies benefit the greatest number of people around the world will be my proudest.

As an industry, how we support our patient communities is critical. When it’s done well, we are appreciated and often treasured.

When sickle cell patients and advocates learned of GBT’s acquisition by Pfizer, the response was emotional. It was like losing a member of their family. But the community also saw the big picture, and the possibility that Pfizer could accelerate the transformation of a long-neglected disease.

They knew that they would remain at the center of what we do.

Why it’s time to elevate the biotech industry’s voice

Re-framing our industry’s narrative and increasing access to our innovations go together, and they have been my top priorities since I became Chair of BIO.

A third priority is helping to elevate the industry voice at the federal, state, and international levels. Here in Georgia, you have the excellent leadership of Maria [Thacker-Goethe] and Georgia Bio. As Chair of the Council of State Bioscience Associations – better known as CSBA – Maria works closely with BIO on a host of policy priorities.

Together, we are fighting to restore the immediate full R&D tax credit so small and mid-sized biotech have more capital. The economic environment is critical for biotech, which is why we are also pushing back on problematic provisions of the Inflation Reduction Act.

These are provisions that reduced incentives, and will limit our ability to bring new therapies and innovations forward. If unaddressed, they will result in fewer drugs and innovations to help our patients and society.

Here in Georgia, your focus on talent development, personalized medicine, and the role of artificial intelligence are critical to ensuring a strong and diverse industry for years to come.

I urge every one of you to participate in our important advocacy work. But I also want you to think big. The mRNA breakthrough took years but arrived in time for COVID. We should all ask ourselves, “What nascent research is happening right now that will be critical and lifesaving tomorrow?”

Biotech is about seeking new opportunities and turning dreams into reality. We must stay true to these principles, while keeping patients and society as our North Star. That will redefine belief in science and biotech.

‘Put patients and our society first’

Lastly, on a more personal note, I want to thank the health community here for your commitment to fighting sickle cell. I came out of retirement to fight this terrible disease, which has affected so many African American families.

One extraordinary person that I so admire is Mapillar Dahn , who I’m sure many of you know here in the Atlanta region. Mapillar gave birth to three beautiful girls, all with sickle cell. She became a leading advocate for sickle cell research and founded the MTS Sickle Cell Foundation. It brings me incredible joy knowing that our work at GBT has helped her daughters lead healthier and happier lives.

We all must be leaders like Mapillar – and so many of you are. My ask to each of you is to take a piece of our challenge back home with you. Put patients and our society first, and make sure we define our narrative. If we do, we will create a more prosperous and sustainable society for all.

Thank you.