A Letter from GCMI Interim Executive Director Saylan Lukas – GCMI’s Continuing Commitment to Excellence in Medtech Innovation

Medtech and life science innovation is rigorous. It requires high levels of acumen and proficiency in multiple disciplines. It can also be immensely capital intensive.

Tiffany Wilson founded Atlanta’s Global Center for Medical Innovation (GCMI) in 2012 to help medtech innovators de-risk their technologies, increasing their odds of successful commercialization and positive patient outcomes within a capital efficient pathway. The organization originated with support from the Office of Innovation and Entrepreneurship, part of the U.S. Department of Commerce’s Economic Development Administration, and an i6 Challenge Grant.

In 2016 GCMI, a Georgia Tech affiliate, acquired responsibility for T3 Labs – an industry leading preclinical CRO – making GCMI truly an end-to-end medtech innovation center. More than six years on, the institutions determined that demand for costly preclinical work, especially good laboratory practices (GLP) studies required by regulatory submissions, is driven too far downstream in the product development process for optimal operational efficiency. GCMI therefore chose to focus on core design and development pathways in a more concentrated fashion leading to the November 2023 sale of T3 Labs to Veranex.

No, GCMI has not been “taken private.”

GCMI’s Continuing Commitment to Excellence in Medtech Innovation

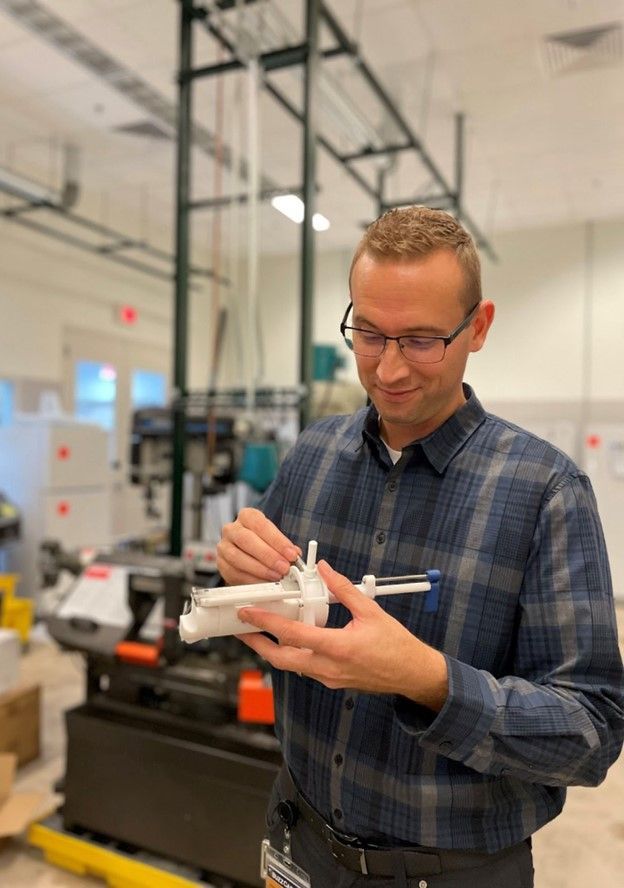

GCMI remains a non-profit affiliate of Georgia Tech. As we have for more than a decade, we help clinician innovators, start up companies, engineers and scientists with university supported technologies, industry partners, hospitals and health systems realize and commercialize new medical technologies. We maintain ISO 13485 compliant quality management systems and possess expertise in all relevant subject matter critical to successful medtech innovation and commercialization. That expertise includes the imperative clinician’s perspective via our Medical Director and pediatric urologist, Emily Blum, MD. We can also serve as manufacturer of record for novel medical technologies including those used in compassionate use provisions and investigational studies.

Our work in support of Georgia’s life science innovation ecosystem specifically includes Hong Yeo’s flexible wireless stethoscope, multiple projects in collaboration with Children’s Healthcare of Atlanta, Piedmont Healthcare physicians and clinical teams, NFant Labs, OXOS Medical and GloShield by Jackson Medical among others. GCMI also plays a pivotal role in the Center for Medtech Excellence (CMTE), which is focused on catalyzing the development and commercialization of breakthrough biotechnology, medical devices, life science and therapeutic innovations. Within CMTE, we have supported Dr. Noze Best and it’s NozeBot Baby Nasal Aspirator and Hub Hygiene’s easySCRUB device.

Georgia’s medtech innovation ecosystem has all of the assets needed for success with high quality of life and lower cost of living compared to locales like Boston and the Bay Area with more august reputations in the discipline. Our ecosystem of clinicians, hospitals, patients, universities, engineers, entrepreneurs, investors, solutions providers and supporting state and municipal resources is robust. Atlanta specifically has additional biomarkers for medtech innovation like grant funding including the Georgia Research Alliance, startups spun out in the past, a mature funding ecosystem and patents issued. Our foundation is strong. Our growth potential is high and GCMI intends to actively foster that growth.

At the end of the day, GCMI is fully committed to successful medtech commercialization that improves outcomes. We welcome you to contact us at any point in a medical technology’s pathway from the ‘back of the napkin’ to the bench, manufacturing, bedside and beyond.

I invite you to take a moment to follow our new organizational profile on LinkedIn and take a look at our new web presence https://gcmiatl.org

Sincerely,

Saylan Lukas

Interim Executive Director, Global Center for Medical Innovation