Emory, Georgia Tech & Children’s Healthcare land major NIH grant for diagnostics

The National Institute of Biomedical Imaging and Bioengineering of the National Institutes of Health has awarded $7.8 million over the next five years to the Atlanta Center for Microsystems Engineered Point-of-Care Technologies (ACME POCT) to support inventors across the country in developing, translating and testing microsystems-based point-of-care technologies to help improve patient care.

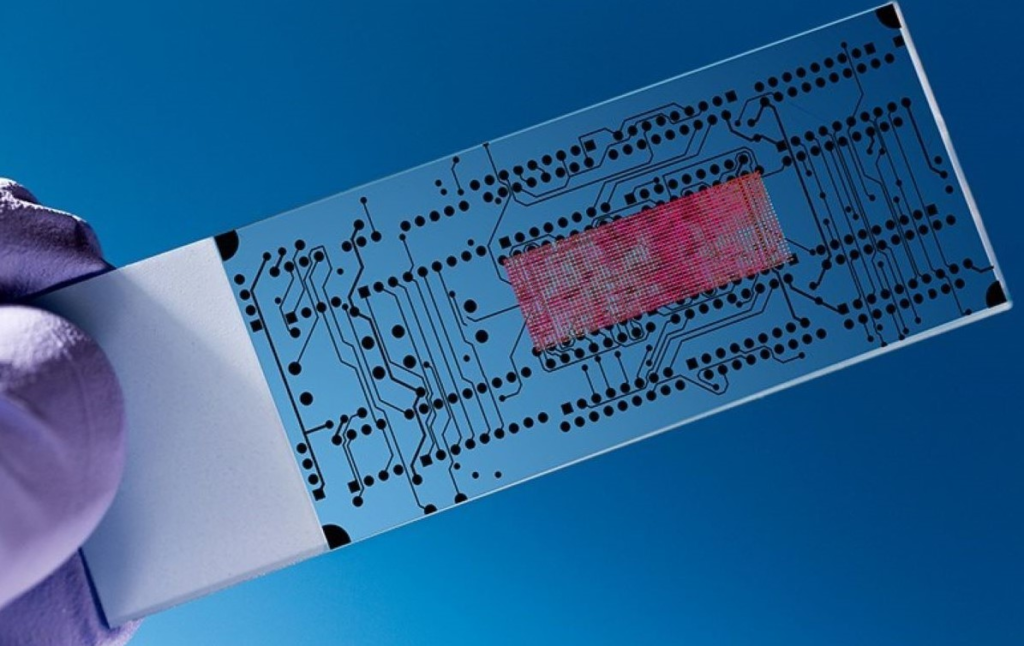

Point-of-care technologies are medical diagnostic tests performed outside the laboratory in close proximity to where a patient is receiving care. This allows health care providers to make clinical decisions more rapidly, conveniently and efficiently.

AMCE POCT , which is one of six sites in the U.S. selected by NIH as part of the NIH Point-of-Care Technologies Research Network, was originally established in 2018 to foster the development and commercialization of microsystems (microchip-enabled, biosensor-based, microfluidic) diagnostic tests that can be used in places such as the home, community or doctor’s office. The center played a pivotal role during the onset of the COVID-19 pandemic as the national test verification center to rapidly evaluate COVID-19 tests and help make them widely available.

“Our center was just getting its footing established when the pandemic began, and our unique combination of technical, laboratory and clinical expertise allowed us to rapidly pivot our focus and capabilities to address critical needs during the COVID-19 pandemic,” says Greg Martin, MD, one of the three principal investigators and a professor in the School of Medicine’s Division of Pulmonary, Allergy, Critical Care and Sleep Medicine.

Having facilitated the transformation in at-home and point-of-care diagnostics for COVID-19, ACME POCT will apply this experience and expertise to a broad range of health care needs.

“The pandemic has taught us – physicians, scientists, the public, and society as a whole – the importance of point-of-care technologies in rapid disease diagnosis and public health,” says Wilbur Lam, MD, PhD, pediatric hematologist and oncologist at Children’s Healthcare of Atlanta, professor of pediatrics and biomedical engineering at Emory University and Georgia Institute of Technology. “Our center is honored to continue its role as the technology-focused center within the NIH’s POCTRN and we’re excited to apply the lessons we’ve learned to foster POC technologies beyond COVID-19 to ultimately improve patient care and public health on multiple fronts.”

The ACME POCT uniquely leverages Atlanta’s nationally top-ranked clinical programs at Emory Healthcare and Children’s Healthcare of Atlanta, one of the nation’s largest pediatric hospital systems, as well the internationally acclaimed microsystems expertise at the Georgia Institute of Technology.

Microsystems technologies have been employed to develop microfluidic technologies that enable the collection of microliter samples of fluid, such as blood, for downstream analysis. They have also proven useful in smartphones as sensors for medical applications and in wearable electronics, which enable “on patient” sensing of physiologic and biomedical signals.

Eric Vogel, PhD, principal investigator and Hightower Professor of Materials Science and Engineering at Georgia Tech, adds, “because of their small size(<1mm), low power requirements and advanced engineered materials, microsystems diagnostics provide portability that is vital for point-of-care testing. The NIH funding for ACME POCT enables microsystems-based POC inventors from across the country to refine their technology with the objective of accelerating the path to translation and clinical adoption.”

Since its founding in 2018, ACME POCT has funded 22 projects from 17 different institutions or companies. As Atlanta biomedical innovation has flourished in the last 4 years with the launch of the Emory/GT/Children’s ADJUST Center and the AppHatchery clinical smartphone app development program, ACME POCT aims to capitalize on this growing innovation ecosystem and use a “disease inclusive” approach to move the field of microsystems-based technologies forward in Atlanta and beyond.